Investment strategy

and teamwork

and following

The minimum amount of our investment share is €0,4 million, average participation ranges from €1.5 – 2 million. The final amount of funds and its structuring are project-specific and evaluated exclusively on a case-by-case basis.

€0.4 – 7 million

Starting in June 2020, we have 6 years left to find and fund your ambition’s plans. The life span of the fund is set at 10 years, during which time we will endeavour to bring the company to a successful exit.

3-7 years

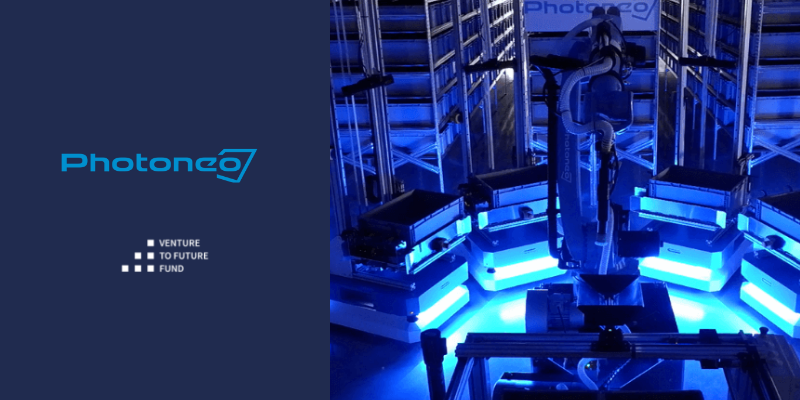

Portfolio

Nettle AI

Nettle AI develops sophisticated tools powered by artificial intelligence that comprise comprehensive conversational platforms in the form of a virtual assistant. Thanks to artificial intelligence and machine-learning tools for structured data extraction and automated language processing (NLP), their solutions can autonomously resolve a broad range of challenging problems. Nettle AI's conversational artificial intelligence ranks among the best in the world and is used to communicate with customers by major technology companies and financial institutions including Eset, Samsung, ČSOB and 365 banka, among others.

News

About us

Investors

“The combined participation of the Fund and its co-investors will facilitate the emergence of a next generation of business champions in Slovakia.”

Lilyana Pavlova, Vice-President of European Investment Bank (EIB)

Venture to Future Fund is a joint initiative of EIB, the Ministry of Finance of the Slovak Republic, and the Slovak Investment Holding. It is the first venture capital fund of its kind in the CEE region that has lured EIB´s capital.

Team

Matej Říha

Chairman of the Board

Matej has 15+ years’ experience in managing positions in M&A, transaction advisory, and investment and corporate banking (Patria Finance/KBC Group, VUB/Intesa Sanpaolo Group, and OTP Group). Before joining Venture to Future Fund, he served as executive manager for the JEREMIE holding fund in Slovakia. Matej graduated from the University of Economics in Bratislava, majoring in finance, banking and investing.

Martin Banský

Vice-chairman of the Board

Martin has 15+ years’ experience in the field of transaction advisory, M&A, and investment banking (e.g. WOOD & Co., Patria finance) as well as in the banking sector (Tatra banka, VUB bank). High on the list of his managerial accomplishments is the sale of a part of Slovak Telekom; he has also led a number of M&A transactions within the mining, pharmaceutical and aviation industries. He graduated from Matej Bel University in Banska Bystrica, majoring in finance, banking and investing.

Miriama Hanout

Board Member

Mirka has spent more than 8 years working in the field of M&A, transaction advisory, investment banking, and financial planning (AZC Group, CSOB Advisory, Corpia Group). She was in charge of several acquisition projects within the agriculture, biofuels and food industries, and also in the post and telecommunications sectors. She graduated from the University of Žilina, majoring in economics and management; she also studied at the University of Jyväskylä, Finland.

Contact